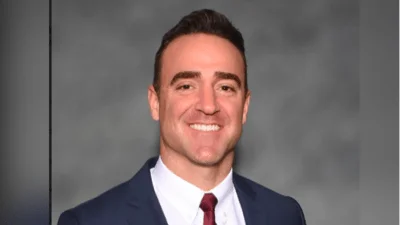

Rep. Mark Batinick | repbatinick.com

Rep. Mark Batinick | repbatinick.com

As a new WalletHub study ranked Illinois the least tax-friendly state in the country, Rep. Mark Batinick (R-Plainfield) calls for alleviating Illinoisans' tax burden.

"Illinois is once again ranked dead last when it comes to tax-friendliness, with the highest effective total state and local tax rates in the nation. If we want families to move here, stay here, and thrive then we have to take some of the burden off our hardworking residents. Let's make Illinois a destination for growth and get out of last place," Batinick posted on Facebook.

The WalletHub study ranked Illinois the least tax-friendly state in the country, with the average Illinois household paying more than $9,000 in taxes every year. In Alaska, which was ranked the tax-friendliest state, the average household pays around $4,585 every year in taxes.

"According to the study, we pay about 39% more taxes than the average American," Fox Chicago noted. However, there is one point that’s good about Illinois – the residents here pay the lowest vehicle property taxes compared to other states.

In his three years in office, Gov. J.B .Pritzker has imposed 24 tax and fee increases, costing Illinoisans $5.2 billion. These increases include doubling the motor fuel tax in 2019, increasing vehicle registration fees by $50, and increasing taxes on cigarettes, e-cigarettes, and video game consoles, according to Illinois Policy.

Alerts Sign-up

Alerts Sign-up