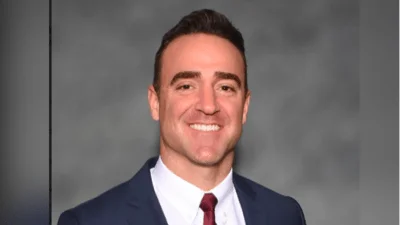

Rep. Mark Batinick said Democrats should reduce taxes for Illinois residents every year, not just during election years. | State Rep Mark Batinick/Facebook

Rep. Mark Batinick said Democrats should reduce taxes for Illinois residents every year, not just during election years. | State Rep Mark Batinick/Facebook

State Rep. Mark Batinick (R-Plainfield) blasted Democrats this week for their approach to providing relief to Illinois families.

If Democrats want to help the residents of Illinois, they should focus on reducing taxes for the state's population, according to Batinick.

"Democrats' temporary, election-year tax measures do not go nearly far enough," he said in a Facebook post. "If our colleagues on the other side of the aisle were serious about providing relief to struggling Illinois families, they would work to reduce taxes every year, not just when it's politically convenient."

State legislators are searching for ways to reduce the effects of rampant inflation around the country and sky-high gas prices in Illinois on taxpayers.

Illinois prior to this month was one of only 13 states still imposing a tax on groceries, CNBC reported.

This tax will be suspended for one year, effective July 1, according to Newsweek. The 1% tax will be removed from grocery bills but will remain on medical and hygiene products. Candy and alcohol will be taxed at 6.25%.

In addition to suspending the tax on groceries, Illinois Democrats passed legislation that will postpone the scheduled gas tax increase of 2.2 cents from July to next January, FOX 32 Chicago reported. Gas stations in Illinois are required to notify customers of the postponement via stickers on gas pumps.

The gas tax increase delay is part of a bundle of tax rebates and delays in the record $46.5 billion Fiscal Year 2023 budget, according to Illinois Policy. Altogether, the package of relief being provided to Illinois residents is expected to save the average family $556.

The 2.2-cent increase in the gas tax will take effect in January and will be followed by another increase in July 2023. The second tax hike will likely be 3.8 cents per gallon, bringing Illinois' total gasoline tax up to 45.2 cents per gallon.

Alerts Sign-up

Alerts Sign-up