Frankfort mayor talks property taxes | Courtesy of Shutterstock

Frankfort mayor talks property taxes | Courtesy of Shutterstock

Property taxes are a big – perhaps the biggest – issue for Illinois in 2017.

At an average of 2.67 percent of a home value, property taxes are more than twice the national average, according to the Chicago Tribune. That means the owner of a $300,000 home in Will County is paying $8,010 per year, versus a maximum of $3,000 for the same value house just across the border in Indiana.

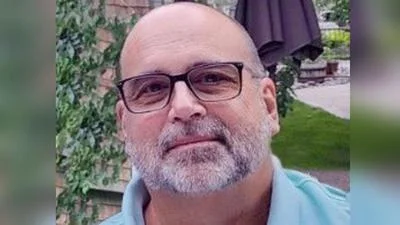

Will County Gazette recently talked with Frankfort Mayor Jim Holland about property taxes, why they are so high and what he plans to do about them.

Q: Why are property taxes so much higher in Illinois than in other states?

A: Because of the way the state funds the schools, 70 percent of the property taxes goes to the schools, and the state should fund schools from other taxes and then require the schools to reduce their property tax. That’s how true property tax reform can be done. It requires action by the state of Illinois.

Q: Do Illinois local governments spend too much money?

A: Most of the money that Frankfort receives comes from sales tax. In fact, the village of Frankfort has lowered its property tax rate every year that I have been mayor. That has meant that from about 2008 until 2015 the amount of money that Frankfort has collected from property taxes has gone down every single year. We have not collected more money; we have collected less.

The problem for our residents is that we are only 4 percent of the property tax bill – we are a very, very small part of it. So what I have been working on as a more senior mayor in the Will County area is working with other mayors and organizations like the Will County Governmental League and the Metropolitan Mayor’s Caucus to have true property tax reform at the state level, to have the state fund the schools and help fund the local government the way our constitution says they are supposed to be funded.

Q: How much does the village of Frankfort owe to fire and police pensioners, currently? What would property taxes have to be to pay that?

A: A significant amount. Our police pension fund has about $11 million in it and that is not adequate funding for the pensions that the state has given to the police. The state of Illinois, again, determines what the pension is and how much the police get in their pension benefits. The state decides when the policemen can retire, the state decides how much the policemen get, the state decided all of the issues with the benefits of the pensions, but the local taxpayer has to pay for it. And we have no say in it whatsoever; we are just required to pay for it.

Frankfort’s police pensions … it’s being corrected. We’re just having to put more tax money into it to correct it. It’s not a serious problem. We can afford to make good on it, but it is underfunded.

Q: What's the problem with public pensions? Do employees save enough?

A: That’s one of the (questions) for the pension system. I believe the policemen are paying a fair amount into their own pension, I think it’s 11.9 percent of their salaries, so they are paying something into their own pension fund. One simple answer could be that new policemen may have to pay a significant amount more and may have to retire a little later date, or receive a little less benefit.

The most obvious way is to correct the pension problem is to have a program for new all employees. That’s perfectly legal, there’s no challenge to it and it can be done immediately. It’s a very simple thing to do, but we can’t do it – it has to be done by the state of Illinois.

Q: Do you have a volunteer fire department. Have you considered it? If not, why not?

A: No. Our area is covered by a fire district. It’s a separate government so it has nothing to do with the village government. Some villages have fire departments; other areas of the state are covered by fire districts. We happen to be covered by a fire district, so we don’t get into any of the fire issues, except that we work together regularly.

Q: What else can a mayor do to impact property taxes?

A: I think that the things that we are doing, that I’m doing at the state level, are the most important thing that we all can do to impact property tax reform. The primary place, again, that property taxes go are schools, and that’s happened in this state because the state has not funded the schools according to the state constitution. They just haven’t done it, so the local taxpayers have picked up the difference.

To correct the problem, the state must provide a significant amount more money to the local school districts, and at the same time the schools districts should reduce their property taxes and people would see the change in their property tax bill immediately.

Alerts Sign-up

Alerts Sign-up