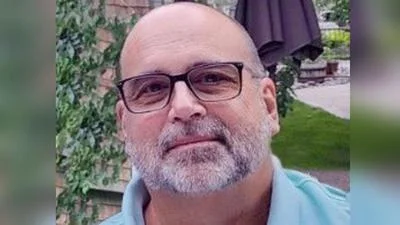

State Rep. Mark Batinick | File photo

State Rep. Mark Batinick | File photo

Republican House Floor Leader Mark Batinick warns there will be consequences to Gov. J.B. Pritzker getting what he seems to want most.

“I’m waiting for the analysis that tells us how many people will leave Illinois if this progressive tax the governor is trying to ram through actually becomes law,” Batinick told the Will County Gazette. “Then you need to ask yourself how it will impact all the rest of us that are still here,” he said.

A new Illinois Policy Institute analysis projects that small businesses across the state soon could be forced to pay as much as a 50.3% marginal income tax rate should the tax appearing on the Nov. 3 ballot in the form of a referendum question garner the support it needs for passage. Ignoring growing warnings from many that the tax stands to handcuff small business owners even more, the governor continues to push his signature proposal as one that will only mean higher tax rates for the state’s most affluent residents.

At around 60% of net job creation, small business owners currently rank as the state’s biggest job creators. But those numbers could soon be on the decline, with researchers finding an increase in the top marginal tax rate could mean a slide in the hiring practices of entrepreneurs and slumping earnings for workers.

“I don’t know how we can expect Illinois to be the same with all these things happening,” Batinick added. “The state has been slowly eroding for years and this will mean even more of that.”

While some argue the disconnect between the governor and the people he’s supposed to represent seems to stem from his billionaire status and insulated lifestyle, Batinick isn’t so sure.

“I don’t think it’s an issue of relatabilty at all,” he said. “All kinds of different people from different income brackets and different walks of life think he’s totally wrong with this tax and that it’s all wrong for Illinois.”

Between now and Election Day, Batinick said he plans to continue to try to convince as many voters as he can to reject the measure.

“I talk about it every day and will continue to do that,” he said. “We need to take a stand.”

Alerts Sign-up

Alerts Sign-up